Politics

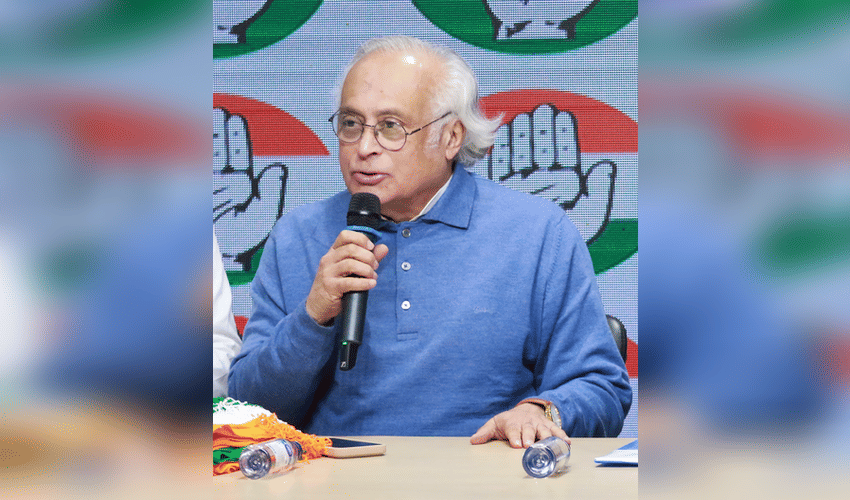

Headline numbers for inflation-adjusted GDP growth rates are deceptive, says Jairam Ramesh

Published On Thu, 15 Jan 2026

Asian Horizan Network

71 Views

New Delhi, Jan 15 (AHN) The Congress on Thursday alleged that the headline GDP growth rates presented after adjusting for inflation paint a misleading picture of the economy, arguing that they mask weak underlying demand and structural issues affecting investment.

Congress General Secretary in charge of Communications, Jairam Ramesh, said that the inflation-adjusted growth figures appear inflated because the price deflators used are unusually low.

“The headline numbers for inflation-adjusted GDP growth rates are deceptive. The price deflators are themselves very low, and hence these rates get magnified,” he said.

Ramesh claimed that while low price deflators may be projected as a positive outcome by the government, they actually reflect subdued consumer demand.

“Low price deflators may cause cheer to the Modi government, but they are the result of low consumer demand on account of income levels which have stagnated outside the very top of the pyramid,” he added.

Highlighting the disconnect between corporate profitability and investment, the Congress leader pointed out that corporate India is currently sitting on large cash reserves. “Corporate India is flush with cash. Profits are at record highs and debt at record lows,” he said, but questioned why this has not translated into higher capital expenditure.

He said the upcoming Union Budget must directly address this concern. “The question that the forthcoming Budget has to address boldly is simply this: why are companies more focused on managing wealth in financial markets instead of making investments in capacity expansion? The investment climate clearly needs a huge booster dose,” Ramesh said.

Criticising the government’s economic strategy, he argued that successive tax cuts for corporates have failed to revive demand. “The slew of tax cuts has clearly failed to stimulate demand,” he remarked.

Ramesh further contended that the issue goes beyond fiscal policy and is rooted in the broader political economy model of the current government. “The answer, unfortunately, goes beyond fiscal decisions but points to the political economy model of the government,” he said.

He alleged that increasing market concentration and government patronage are discouraging genuine competition and private investment.