Pakistan’s vulnerable external financing structure continues to threaten economic stability, with policymakers warning that heavy reliance on foreign borrowing leaves the country susceptible to repeated financial crises. Business leaders and economists note that although foreign exchange reserves have improved recently, they do not address the deeper structural issues within the debt repayment schedule, according to The Express Tribune.

Reports indicate that a significant portion of Pakistan’s debt consists of short-term obligations, which restricts the government’s capacity to withstand economic shocks. Pakistan Industrial and Traders Associations Front Vice Chairman Raja Waseem Hassan urged officials to urgently negotiate repayment extensions with allied nations. He warned that without longer repayment periods, the country will continue to face recurring balance-of-payments pressures. As of September 2025, Pakistan’s external debt and liabilities were approximately $134.5 billion, with major repayments due soon. While reserves exceeded $21 billion in January 2026, analysts emphasize that much of this increase is due to multilateral assistance and short-term bilateral support, while future repayment commitments remain significant.

Hassan acknowledged that renewed diplomatic outreach to Gulf countries, potential investments from Saudi Arabia and the UAE, and improving relations with the United States are positive developments. However, he cautioned that geopolitical support cannot replace strong domestic economic fundamentals. He stressed that long-term stability depends on improved competitiveness, higher productivity, and reliable financial buffers. Comparing Pakistan to neighboring economies that successfully negotiated during global trade tensions, he pointed out that Pakistan’s limited export base and slow economic expansion have reduced its bargaining power. Exports remained around $32 billion in FY25, still insufficient to cover import needs despite restrictions, The Express Tribune reported.

Senior economist Saleem Ahmed shared similar concerns, stating that reliance on loan rollovers and foreign deposits cannot serve as a permanent solution. He emphasized that managing debt maturities must be paired with structural reforms in taxation, energy pricing, and industrial productivity. With economic growth expected to remain below five percent and credit conditions tight, businesses are hesitant to expand. Both experts called for urgent measures to widen the tax base, reduce losses in the energy sector, boost value-added exports, and attract stronger foreign investment to ensure sustainable economic stability.

Disclaimer: This image is taken from Reuters.

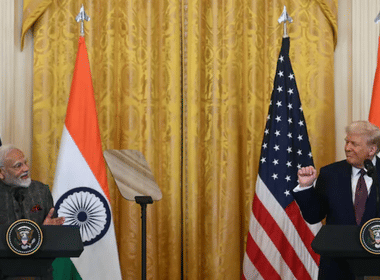

India is holding discussions with Brazil, Canada, France, and the Netherlands on partnerships to jointly explore, mine, process, and recycle critical minerals, as it steps up global efforts to secure essential raw materials, sources said. The talks are centered on lithium and rare earth elements, with India also seeking access to advanced mineral-processing technologies. The sources requested anonymity due to the confidential nature of the negotiations.

India’s heavy dependence on China, which dominates global supplies and processing of many critical minerals, has heightened the urgency to diversify sourcing as the country pushes ahead with its energy transition and emission-reduction goals, industry experts noted. Mining projects typically take years to materialize, with exploration alone lasting five to seven years and often failing to result in commercially viable operations. India is looking to model these potential agreements on a critical minerals pact signed with Germany in January, covering exploration, processing, recycling, and the acquisition and development of mineral assets domestically, bilaterally, and in third countries.

According to one source, discussions are ongoing with France, the Netherlands, and Brazil, while a proposed agreement with Canada is under active review. The Ministry of Mines is spearheading these efforts. Canadian Prime Minister Mark Carney is expected to visit India in early March, during which agreements related to uranium, energy, minerals, and artificial intelligence may be signed. Canada’s Natural Resources Department, responding to queries, pointed to a January statement confirming plans to formalize cooperation on critical minerals in the coming weeks.

Brazil’s embassy in New Delhi, along with India’s Ministry of Mines and the Ministry of External Affairs, did not respond to requests for comment. The Dutch embassy offered no comment, while France’s embassy declined to respond. India has been actively pursuing critical minerals worldwide, already signing agreements with Argentina, Australia, and Japan, and holding talks with Peru and Chile on broader bilateral arrangements that include mineral cooperation.

These efforts coincide with recent discussions among G7 and other major economy finance ministers in Washington on reducing dependence on Chinese rare earth supplies. In 2023, India designated more than 20 minerals, including lithium, as critical to its energy transition and to meet growing industrial and infrastructure demand.

Disclaimer: This image is taken from Reuters.

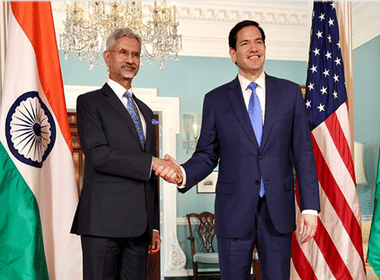

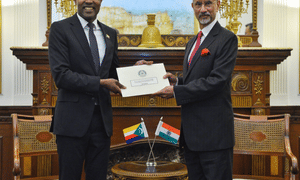

Minister of External Affairs S. Jaishankar met with Comoros Foreign Minister Mbae Mohamed in New Delhi today. In a post on X, Jaishankar said, “A pleasure to meet Foreign Minister Mbae Mohamed of Comoros today. We discussed cooperation in health, sports, infrastructure, and capacity building, and agreed on the importance of more frequent engagements between our countries.”

Mohamed had arrived in New Delhi just a day earlier to attend the 2nd India-Arab Foreign Ministers’ Meeting (IAFMM) scheduled for Saturday. MEA spokesperson Randhir Jaiswal noted that the visit would further strengthen the friendly relations between India and the Union of Comoros. Through X, Jaishankar welcomed him, saying his visit would enhance bilateral ties.

India and Comoros established diplomatic relations in June 1976. The Embassy of India in Antananarivo is concurrently accredited to Comoros. The two countries share close and friendly ties, with similar positions on several regional and multilateral issues. Comoros has been a member of the Indian Ocean Rim Association (IORA) since 2012 and the International Solar Alliance since 2017. The Indian diaspora in Comoros numbers around 250 people, mainly involved in trade, business, and other professions, contributing significantly to the local economy.

The 2nd India-Arab Foreign Ministers’ Meeting, co-chaired by India and the UAE, will include Foreign Ministers from Arab League member states and the Arab League Secretary-General. The meeting comes after a 10-year gap, the first having been held in Bahrain in 2016, which identified five priority areas: economy, energy, education, media, and culture. The upcoming meeting aims to expand and deepen cooperation under this framework.

The India-Arab Foreign Ministers’ Meeting is the highest institutional mechanism for the partnership, formalized in 2002 through an MoU between India and the League of Arab States. The Arab-India Cooperation Forum was established via a Memorandum of Cooperation in 2008 and revised in 2013. India is an Observer to the League of Arab States, which represents 22 Arab countries. This is the first time India is hosting the IAFMM in New Delhi, with participation from all 22 Arab nations at various ministerial and senior official levels. The meeting will be preceded by the 4th India-Arab Senior Officials’ Meeting on Friday.

Disclaimer: This image is taken from X/@DrSJaishankar

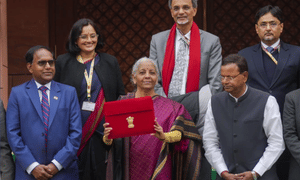

The Economic Survey for the year two thousand twenty five to two thousand twenty six notes that negotiations for a trade pact with the United States are likely to be wrapped up within the year, a move that could ease uncertainty on the external front. For India, the Survey explains that global developments pose risks mainly in the form of external uncertainty rather than immediate macroeconomic pressure. It points out that slower growth in major trading partners, trade disruptions caused by tariffs, and fluctuations in capital flows may at times affect exports and investor confidence.

At the same time, the Survey highlights that progress in talks with the United States could help stabilise the external environment once concluded. India and the United States have been discussing a bilateral trade agreement since March last year, with six rounds of talks completed so far. Progress has been gradual, largely due to the United States imposing steep tariffs on Indian goods starting August last year.

In December two thousand twenty five, a delegation from the Office of the United States Trade Representative, led by Deputy Trade Representative Ambassador Rick Switzer, visited India for discussions. This marked the second visit by US officials since higher tariffs and additional penalties were imposed on Indian exports following concerns related to India’s purchase of Russian crude oil.

Disclaimer: This image is taken from Business Standard.

2026 is shaping up to be a defining year for the AI-driven economy. According to Saxo Bank’s latest analysis, the upcoming IPO pipeline is dominated by tech giants poised to move from private backing to public scrutiny. While OpenAI and Anthropic represent high-risk, high-reward bets on generative AI, companies like Canva and Stripe showcase more established models in SaaS and Fintech at scale. Andrea Heng and Susan Ng highlight the key factors investors should monitor — including governance, computing costs, and revenue sustainability — as these “private unicorns” prepare for their public market debut, with insights from Chan Yew Kiang, ASEAN IPO Leader at EY.

Disclaimer: This podcast is taken from CNA.

During the daily markets segment on Open For Business, hosts Andrea Heng and Hairianto Diman engage in an in-depth discussion with Rachana Mehta, who serves as the Head of Regional Fixed Income at Maybank Asset Management, exploring the latest trends, insights, and developments in the financial markets and their potential impact on investors and the broader economy.

Disclaimer: This podcast is taken from CNA.

A week after Palestinian Australian author Randa Abdel-Fattah was removed from the Adelaide Writers’ Week lineup, the festival’s organisers have issued a full and unconditional apology. The South Australian event faced turmoil after her exclusion, leading over 180 writers to withdraw in protest. With a newly appointed board, the organisers expressed regret for the damage caused and extended an invitation to Abdel-Fattah to speak in 2027. Dr. Abdel-Fattah spoke with Nour Haydar about her potential defamation case against the South Australian premier and the broader significance of this incident.

Disclaimer: This podcast is taken from The Guardian.

On Open For Business, Andrea Heng and Hairianto Diman discuss daily market trends with Kingsley Jones, Chief Investment Officer at Jevons Global. They analyze US equities, precious metals, and Hong Kong markets, providing insights into current market movements, investor sentiment, and strategies for navigating volatility in global financial markets.

Disclaimer: This podcast is taken from CNA.